In the rapidly rising FinTech sector, startups and businesses have unprecedented opportunities to innovate within financial services. However, the path to creating a successful FinTech app is fraught with challenges, from navigating complex regulations to meeting a diverse clientele's digital banking and financial management needs. Addressing these hurdles is essential for developers aiming to transform how people manage their financial goals and interact with financial institutions.

Aloa stands at the forefront of this transformative wave, offering software development expertise to businesses and startups keen on penetrating the fintech market. With a rich background in the FinTech industry and a robust portfolio of app development projects, Aloa brings reliability and innovation to the table. This expertise helps overcome the common obstacles of building top fintech applications.

This blog provides a comprehensive guide on how to build a FinTech app tailored to 2024's market trends. From highlighting essential features to exploring the FinTech trends in 2024. Afterward, you will gain insights into developing apps that cater to modern-day banking services, payment options, and personal loans.

Let's get started!

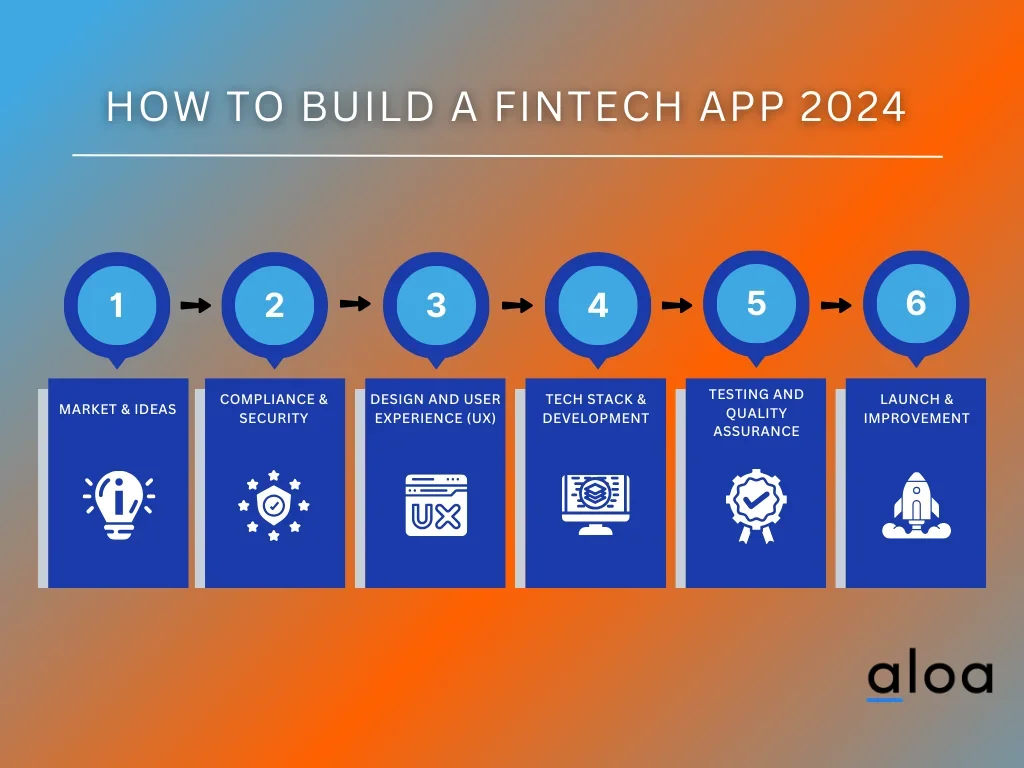

How to Build a FinTech App 2024

Building a successful FinTech app in 2024 requires a strategic blend of industry insight, technical skills, and a keen eye on emerging trends. As the FinTech industry evolves rapidly, understanding the landscape and leveraging the expertise of the best FinTech application developers becomes crucial.

Let's walk through the essential steps to turn your vision into a reality, ensuring your app stands out in the crowded FinTech marketplace.

Step 1: Market Research and Ideation

Market research and ideation is a pivotal first step in building a successful FinTech app. This process lays the groundwork for developing a product that fills a market gap and resonates with your target audience. Here's how to approach it:

- Identify Your Niche: Delve into the FinTech sector to find areas ripe for innovation. Whether it's personal finance, payments, trading, or lending, select a niche where you can make a significant impact.

- Analyze Competitors: Examine top FinTech apps, noting their strengths and weaknesses. Tools like SWOT analysis can provide insights into where competitors excel and where there are opportunities for differentiation.

- Understand User Needs: Conduct surveys, interviews, and focus groups to gather information on potential users' preferences, pain points, and desired features. This feedback is invaluable for tailoring your app's functionality and user experience.

- Spot Market Gaps: Look for unmet needs within your chosen niche. These gaps are potential opportunities for your app to offer something unique and valuable.

- Craft Your Value Proposition: Define what makes your app different and better based on your research. This unique value proposition (UVP) should clearly articulate your app's benefits to users.

Taking these steps ensures that your FinTech app is built on a solid foundation of market understanding and user-centric design, setting the stage for its future success.

Step 2: Regulatory Compliance and Security

Navigating the complex regulatory landscape is paramount in developing a FinTech app. Understanding legal requirements and compliance standards across your target markets is non-negotiable. Early implementation of robust security measures, such as data encryption and secure authentication methods, is essential to safeguard user data and build trust. Adherence to specific regulations, like the General Data Protection Regulation (GDPR) in Europe or the Payment Services Directive (PSD2), ensures your app meets the highest privacy and security standards.

This proactive approach to regulatory compliance and security minimizes the risk of legal complications and positions your app as a reliable and secure choice for users. Tailoring your compliance strategy to the nuances of each geographical market enhances your app’s global appeal and ensures a seamless, secure user experience across borders.

Step 3: Design and User Experience (UX)

Designing a user-friendly interface is paramount in creating a FinTech app, where simplicity and ease of use are crucial to ensuring a positive user experience (UX). An intuitive UX design facilitates seamless financial transactions and navigation and drives user adoption and satisfaction. Here's a brief breakdown of essential elements to consider:

.webp)

- Intuitive Navigation: Ensure that users can easily find what they're looking for without unnecessary clicks or confusion. Simplify the journey to the most critical tasks, such as checking balances, making payments, or viewing transaction histories.

- Simplified Transactions: Design the transaction process to be straightforward, minimizing the steps needed to complete an action. Clarity in transaction forms, confirmation messages, and error notifications enhances user confidence.

- Responsive Design: The app should offer a consistent experience across various devices and screen sizes, ensuring functionality and readability on smartphones, tablets, and desktops.

- Accessibility: Incorporate accessibility features to accommodate all users, including those with disabilities. This includes text readability, voice commands, and easy navigation for a wider audience.

- Visual Clarity: Use clear, visually appealing design elements that align with your brand. Adequate spacing, contrasting colors for essential actions, and minimalistic design can make the app more engaging and less overwhelming.

A well-executed UX design in your FinTech app not only meets the functional needs of users but also fosters trust and loyalty, setting the foundation for long-term success in the competitive FinTech landscape.

Step 4: Technology Stack and Development

Selecting the appropriate technology stack is crucial in developing a FinTech app, as it underpins its performance, scalability, and security. Opt for technologies known for robustness and agility, such as React for front-end development, Node.js for the back-end, and cloud services like AWS for scalable infrastructure. Utilizing agile development methodologies facilitates flexible and iterative design, enabling your team to swiftly adapt to changes and refine the app based on user feedback and testing outcomes.

Partnering with an expert development company like Aloa can be a game-changer. Aloa’s expertise in building high-quality, secure, and scalable FinTech applications ensures that your app meets and exceeds industry standards. With Aloa, you can confidently navigate the intricacies of FinTech app development, from choosing the right technology stack to successfully launching your app.

Step 5: Testing and Quality Assurance

Testing and quality assurance in FinTech app development are critical phases that must be considered. Ensuring the app’s functionality, security, and performance adhere to the highest standards demands a comprehensive testing strategy. Here's a brief overview of the essential testing types each FinTech app must undergo:

- Unit Testing: Validate each component or module works correctly in isolation, ensuring reliability in the app's most minor functional pieces.

- Integration Testing: Assess how well different modules or services work together, highlighting issues in the interaction between components.

- Security Testing: Crucial for FinTech applications, this testing identifies vulnerabilities and ensures data protection, encryption, and compliance with financial regulations.

- Performance Testing: Evaluate the app’s speed, responsiveness, and stability under various conditions, ensuring it can handle high volumes of transactions and users.

- User Acceptance Testing (UAT): Conducted with real users to ensure the app meets their needs and expectations, providing user experience and functionality feedback.

By meticulously conducting these tests, developers can identify and rectify any issues, ensuring the FinTech app is robust, secure, and user-friendly upon launch. This rigorous approach to quality assurance is essential for building trust and ensuring the app's long-term success in the competitive FinTech.

Step 6: Launch and Continuous Improvement

Launching your FinTech app begins a journey towards achieving and maintaining success in the competitive FinTech market. Here’s how to ensure continuous improvement:

- Gather User Feedback: Actively seek and listen to user feedback through surveys, app reviews, and social media. This insight is invaluable for identifying areas for enhancement and new features users desire.

- Monitor Performance Metrics: Utilize analytics tools to track app performance, user engagement, and retention rates. Key metrics can guide decisions on where to allocate resources for improvements.

- Stay Updated with FinTech Trends: The FinTech industry is rapidly evolving. Keep abreast of the latest trends and technologies to ensure your app remains relevant and innovative.

- Iterate and Evolve Your App: Implement an agile development process, allowing regular updates and iterations based on user feedback and emerging market needs.

- Scale Marketing Efforts: As your app matures, adjust and scale your marketing strategies to attract new users while retaining existing ones. Tailored campaigns, referral programs, and promotional offers can be effective tools.

By focusing on these areas, you can ensure that your FinTech app not only stays ahead of the curve but also continuously improves to meet your user base's changing needs and preferences.

Features of a FinTech App

The FinTech sector continues to revolutionize how people manage their finances, from mobile banking to investment options, reshaping personal finance with innovative technologies. Understanding the top features that set a successful FinTech app apart is crucial for anyone looking to hire FinTech application developers.

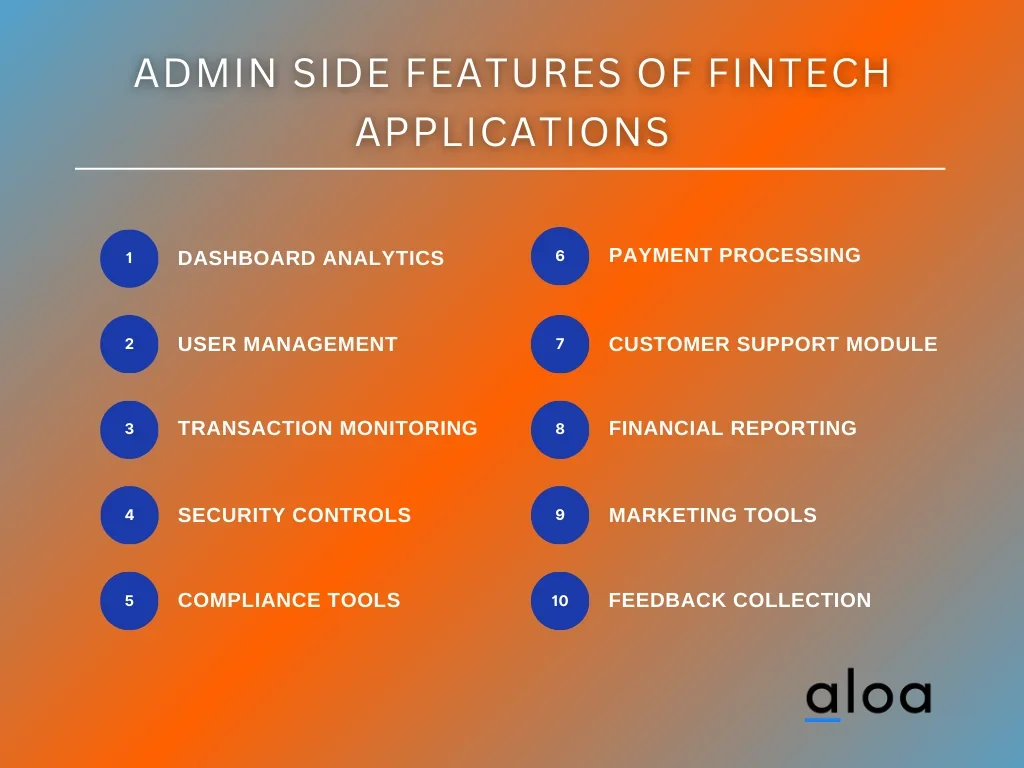

Admin Side Features of FinTech Applications

On the admin side, features are designed to provide control and oversight, ensuring that the app runs smoothly and securely. Here are ten critical admin features:

- Dashboard Analytics: For real-time monitoring of user activities, transaction volumes, and app performance, helping financial advisors and app administrators make informed decisions.

- User Management: Enables administrators to manage user accounts, including activations, suspensions, and permission settings.

- Transaction Monitoring: Essential for tracking all user transactions, spotting unusual activity, and managing commission fees effectively.

- Security Controls: Includes encryption, fraud detection mechanisms, and secure access controls to protect user data and transactions.

- Compliance Tools: Ensures the app meets all regulatory requirements, a vital aspect of the FinTech industry.

- Payment Processing: Admin tools for managing direct deposits, cash advances, and payment settlements.

- Customer Support Module: Provides admins with tools to offer support, manage queries, and resolve issues efficiently.

- Financial Reporting: Generates detailed reports on financial performance, including earnings, withdrawals, and commission fees.

- Marketing Tools: For running and managing promotional campaigns, targeting users based on their behavior and preferences.

- Feedback Collection: Enables admins to gather user feedback directly within the app, facilitating continuous improvement.

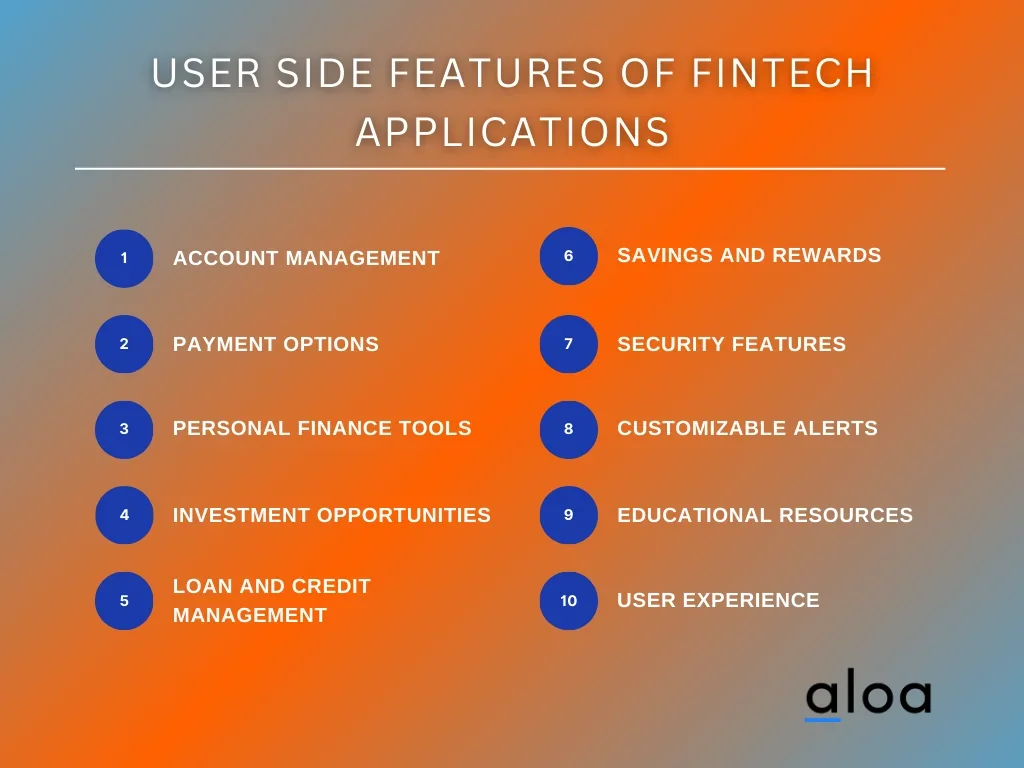

User Side Features of FinTech Applications

A FinTech app must be intuitive, secure, and feature-rich for users, catering to various financial needs. Here are ten essential user-side features:

- Account Management: Allows users to easily manage their bank accounts, credit cards, and investment portfolios in one place.

- Payment Options: Supports various payment methods, including credit/debit card transactions, mobile payments like PayPal and Venmo, and cryptocurrencies through platforms like Coinbase.

- Personal Finance Tools: Features like budgeting, expense tracking, and financial planning help users manage their finances effectively.

- Investment Opportunities: Offers access to various investment options, including stocks, ETFs, and cryptocurrencies, with apps like Robinhood and Acorns leading the way.

- Loan and Credit Management: Helps users manage loans, consolidate credit card debt, understand their credit score, and explore options for improving it.

- Savings and Rewards: Encourages saving through features like automatic spare change investments and rewards like cashback and Nubank reward points.

- Security Features: Protects user data with encryption, secure login mechanisms, and real-time transaction notifications.

- Customizable Alerts: Tell users about their account balances, stock market movements, and upcoming bills or payments.

- Educational Resources: Offers a range of educational resources and tips on personal finance, trading, and investment strategies.

- User Experience: Prioritizes a seamless, intuitive user experience across all mobile devices, ensuring easy navigation and access to features.

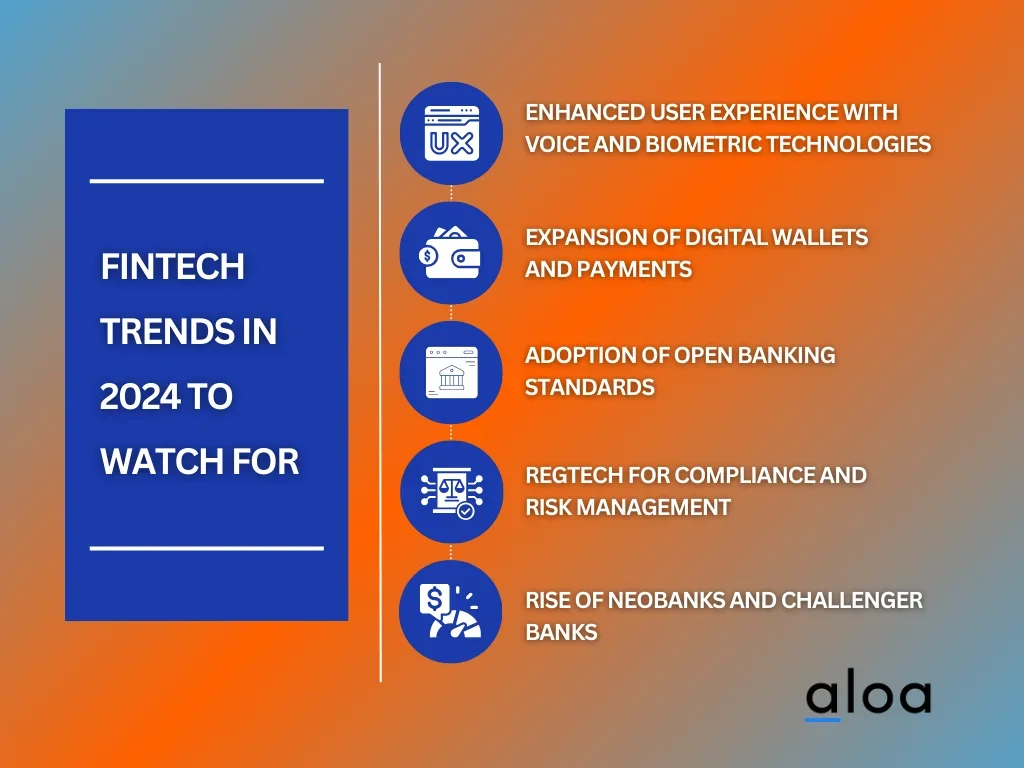

FinTech Trends in 2024 to Watch For

The FinTech app landscape constantly evolves, driven by technological advancements, regulatory changes, and shifting consumer behaviors. As we move into 2024, several key trends are set to shape the development, functionality, and adoption of FinTech applications. Here are five significant trends to watch:

Enhanced User Experience with Voice and Biometric Technologies

In 2024, the FinTech industry will elevate user experiences by integrating voice and biometric technologies into FinTech apps. This trend caters to the growing demand for seamless, secure access to financial services, making it essential for top FinTech applications looking to enhance security and user convenience.

By adopting these technologies, FinTech companies can offer personalized access to services directly through mobile apps, from checking accounts to trading platforms. However, implementing voice and biometric technologies requires careful consideration of privacy concerns and data security, ensuring that users' biometric data are handled with the utmost integrity and transparency.

Expansion of Digital Wallets and Payments

In 2024, the FinTech industry is witnessing a significant expansion of digital wallets and payments, a trend driven by the increasing demand for contactless transactions and the global shift towards cashless societies. Digital wallets streamline the payment process and integrate other financial services, making them a versatile tool for users.

Adopting this trend by FinTech applications allows for a more efficient, secure, and convenient transaction experience. However, implementing digital wallets and payments requires careful attention to security measures, regulatory compliance, and user interface design to ensure a seamless and safe user experience.

Adoption of Open Banking Standards

Adopting open banking standards is revolutionizing the FinTech industry in 2024, shifting towards more transparent, accessible, and collaborative financial ecosystems. Open banking enables third-party developers to create apps and services around financial institutions, facilitating the sharing of financial information more securely and efficiently with the customer's consent.

This trend is being embraced for its potential to enhance customer experiences, offer personalized financial services, and promote innovation within the sector. However, implementing open banking standards necessitates rigorous data protection measures, adherence to regulatory requirements, and the establishment of secure API frameworks to protect sensitive customer information.

RegTech for Compliance and Risk Management

The finTech industry increasingly turns to Regulatory Technology (RegTech) for compliance and risk management solutions. RegTech utilizes advanced technologies such as AI in FinTech, machine learning, and blockchain to streamline and automate compliance processes for financial institutions. This trend is critical in an era where regulatory requirements are becoming more complex and stringent across global markets.

By adopting RegTech, FinTech companies can enhance their compliance posture, reduce operational risks, and improve efficiency. However, implementing RegTech requires a deep understanding of the regulatory landscape, integration with existing systems, and ongoing monitoring to adapt to new regulations effectively.

Rise of Neobanks and Challenger Banks

The rise of neobanks and challenger banks marks a pivotal trend in the FinTech industry in 2024, as these digital-first financial institutions continue to disrupt traditional banking with innovative approaches. Unlike conventional banks, neobanks operate exclusively online or via mobile apps, offering a range of financial services that are typically faster, more user-friendly, and less costly.

This shift reflects consumer demand for more accessible, transparent, personalized banking experiences. The adoption of this trend is fueled by advancements in technology, changing consumer behaviors, and a regulatory environment that supports financial innovation. However, for neobanks and challenger banks to thrive, they must prioritize robust security measures, ensure regulatory compliance, and continuously innovate to meet evolving customer expectations.

Key Takeaway

In the FinTech industry, the success of a FinTech app hinges on a user-centric approach, stringent compliance, and agility in embracing emerging trends. Innovations in trading apps, savings account management, and cryptocurrency transactions with apps highlight the diverse needs of users—from managing paychecks to trading bitcoin, all accessible on Android and iOS platforms.

The best FinTech solutions app meets regulatory standards and exceeds user expectations with seamless, intuitive experiences. For those looking to develop or enhance financial innovation apps, consider partnering with Aloa for expert development services. With expertise in crafting apps that resonate with users and stand out in the marketplace, Aloa is poised to transform your FinTech app ideas into reality.

To explore how we can elevate your FinTech solution, hire an expert FinTech developer today or contact us at [email protected]. Let’s shape the future of finance together.