In 2024, the FinTech payments industry is poised for remarkable growth and transformation. Startups, businesses, and companies increasingly want to incorporate FinTech payment options into their operations to stay competitive in a rapidly evolving landscape. However, this journey has challenges, including regulatory compliance, security concerns, customer trust, and scalability.

At Aloa, we understand the dynamic nature of the FinTech payments landscape. With our experience in this industry, we are committed to helping businesses and startups navigate the challenges that come with these transformative shifts. As the financial services industry continues to see significant disruptions, understanding digital payment solutions is vital for managing cash flow, optimizing payment processing, and harnessing growth potential.

This blog will provide an overview of the FinTech industry and what startups should know about FinTech payment. We will explain how they are transforming the traditional financial landscape through the outlook for FinTech payments. Afterward, you will gain valuable insights into how FinTech is shaping the future of the financial services industry, the challenges and opportunities it presents to businesses, and how innovative payment technology can revolutionize financial operations.

Let's dive in!

FinTech Payments in 2024: 7+ Things for Startups To Know

In 2024, the FinTech payments landscape is transforming remarkably, presenting challenges and opportunities for startups. This dynamic sector is driven by technological innovation in how transactions are processed and managed. Understanding the key trends and shifts is crucial for startups looking to make their mark in this evolving industry.

Let's explore eight critical aspects startups must know to succeed in the FinTech payments landscape in 2024.

1. Higher Demand for Personalized Payment

In 2024, one of the prominent trends in the FinTech payments landscape is the higher demand for personalized payment solutions. Consumers and businesses increasingly seek tailored payment experiences catering to their needs and preferences.

Startups should take note of this trend as it presents significant opportunities for growth and innovation. Personalized payment options can enhance customer satisfaction, increase loyalty, and drive revenue. To capitalize on this trend, startups should consider the following:

- User-Centric Approach: Startups should adopt a user-centric approach, understanding their customers' behaviors, preferences, and pain points. Customizing payment experiences based on customer data can lead to higher adoption rates.

- AI and Machine Learning: Leveraging machine learning algorithms, startups can analyze user data in real time to offer personalized payment recommendations. This can include tailored offers, discounts, and payment schedules.

- Security Measures: As personalized payment options involve handling sensitive financial information, robust security measures are paramount. Startups must invest in cutting-edge security technologies to protect user data.

- Compliance: Stay abreast of the evolving regulatory landscape to ensure that personalized payment solutions adhere to industry standards and data privacy regulations.

The higher demand for personalized payments enhances the user experience and gives startups a competitive edge in FinTech. As consumers seek more personalized financial services, startups can shape the future of FinTech payments in 2024 and beyond.

According to Monetate, personalized experiences can boost sales by an average of 20%, while Epsilon reports that 80% of shoppers are inclined to purchase from companies offering personalized experiences. Additionally, McKinsey's findings reveal that 78% of consumers have selected, recommended, or paid a premium for brands that deliver personalized services or experiences.

2. Use of Automated Software for Optimized Transactions

In 2024, FinTech startups increasingly adopt automated software to enhance their payment platforms and financial services. This automation, driven by artificial intelligence (AI) and machine learning (ML) advancements, is revolutionizing the financial industry by streamlining repetitive and labor-intensive tasks, such as customer verification and screening. This saves time and leads to improved efficiency and customer satisfaction.

Here are the critical considerations for FinTech startups when adopting automated software:

- Agile Platform for Rapid Deployment: Automation tools should offer quick time-to-deployment and adapt seamlessly to dynamic environments, ensuring that startups can quickly respond to market changes.

- Real-Time Data Operations: This is crucial for startups to stay ahead in the fast-paced financial industry. Real-time operations allow for immediate responses to market conditions and customer needs.

- Cloud-based Enterprise Automation: This offers a unified platform for integrating various financial services, which is vital for FinTech startups aiming to deliver seamless and efficient services across digital channels.

- Robotic Process Automation (RPA): RPA is particularly effective for tasks like extracting information from legacy systems, and it works well in situations where the user interface remains constant.

- Customization According to Business Needs: Not all startups require the same level of automation. Some may need end-to-end automation, while others only need to automate specific tasks or processes.

The impact of this shift towards automation is significant for FinTech startups. It enables them to offer faster and lower-cost services than traditional financial institutions. This advantage is crucial in an environment where differentiation and efficiency are vital to attracting and retaining customers. Moreover, with the rise of digital wallets, open banking, and decentralized finance, FinTech startups are poised to offer innovative financial products and services, further solidifying their position in the financial industry.

3. Heightened Security Measures

One of the most critical aspects for startups to focus on within the FinTech payments industry is the implementation of heightened security measures. Heightened security measures involve robust cybersecurity protocols and technologies to safeguard sensitive financial data and prevent unauthorized access. Startups should adopt these measures for several compelling reasons:

- Data Protection: Heightened security measures protect valuable financial information, ensuring that customer data, payment details, and transaction records remain confidential.

- Trust and Reputation: Implementing strong security measures helps build trust among users, which is essential for startups aiming to establish a reputable presence in the FinTech industry.

- Regulatory Compliance: Many regions have stringent data protection regulations. Adhering to these standards is a legal requirement and a critical factor in avoiding penalties and maintaining business operations.

Considerations for startups include protection against various types of cyberattacks, such as phishing attacks, malware, ransomware, and data breaches. Investing in advanced encryption, multi-factor authentication, and regular security audits can help mitigate these threats.

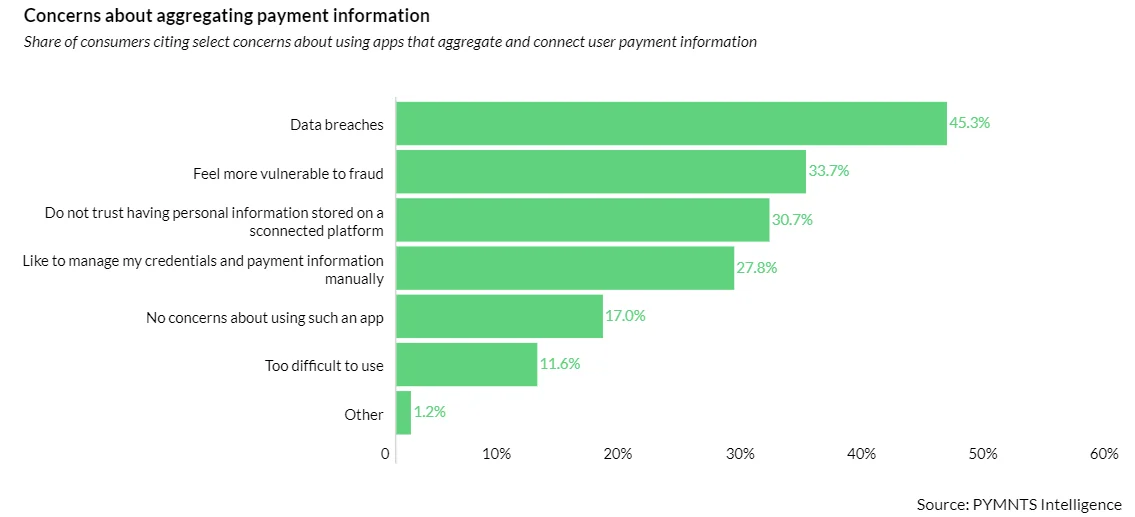

Payment fraud is rising, with an 88% increase since December 2021. For instance, 11% of grocery shoppers experienced fraud in March 2023, up from 5.7% in December 2021. This surge has led to consumer concerns about data breaches and fraud vulnerability, affecting their trust in payment apps and connected platforms. Specifically, 45% fear data breaches, 34% feel more vulnerable to fraud, 30% distrust storing personal info on connected platforms, and 27% prefer manual credential management to reduce risks.

Failure to prioritize security can have dire consequences for startups, including data breaches that result in financial losses, legal liabilities, and damage to their brand reputation. In 2024, as FinTech payments continue to thrive, startups must prioritize security to ensure their customers' and partners' trust and confidence.

4. Increased Investment in Mobile Wallets

Startups should pay close attention to the increasing investment in mobile wallets, a trend that promises significant opportunities and benefits. Mobile wallets are digital applications that allow users to store, manage, and make payments using smartphones. Startups should consider adopting mobile wallet technology for several compelling reasons:

- Growing User Base: Mobile wallets are gaining popularity among consumers, providing startups access to a rapidly expanding user base.

- Enhanced Convenience: Mobile wallets simplify the payment process, offering users a one-stop solution for various transactions, including purchases, bill payments, and peer-to-peer transfers.

- Security Features: Leading mobile wallet providers incorporate robust security features, making transactions more secure and reducing the risk of fraud.

- Integration Potential: Startups can integrate their services with mobile wallets, offering users a seamless and convenient experience.

However, startups should also be mindful of potential cyber threats, such as data breaches and phishing attacks, which can compromise the security of mobile wallet users.

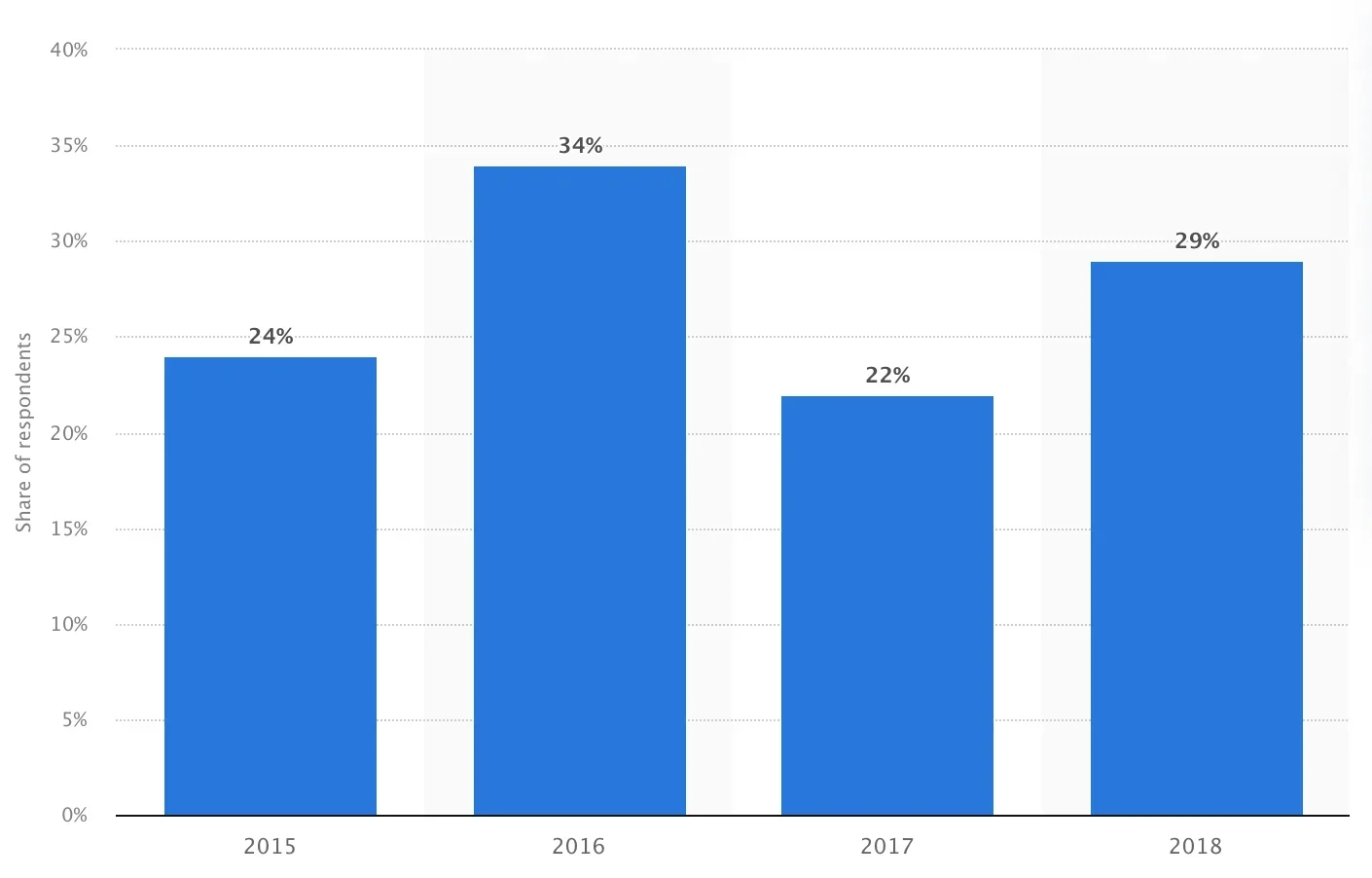

This data illustrates merchants' global acceptance of mobile wallets from 2015 to 2018. In 2015, 24% of merchants worldwide embraced mobile wallets as a payment option, and by 2018, 29% of merchants worldwide were still open to accepting this payment method.

The increased investment in mobile wallet apps like Paypal, Wise, Venmo, and more presents startups with a significant opportunity to tap into a growing market and provide convenient payment solutions. By carefully considering the cybersecurity aspects and delivering a seamless user experience, startups can harness the potential of mobile wallets in the evolving FinTech payments industry of 2024.

5. Tap-to-Pay Features

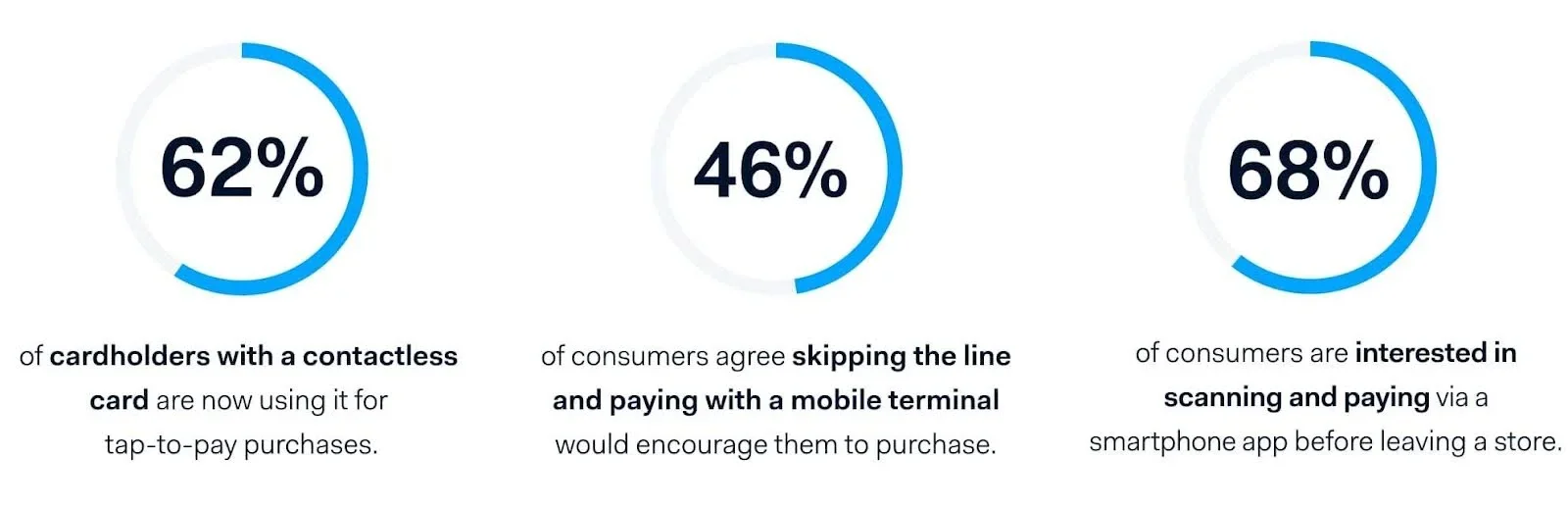

One trend startups must embrace is adopting tap-to-pay features. Tap-to-pay, also known as contactless payment, is a technology that allows users to make payments by simply tapping their mobile devices or credit cards on a payment terminal. Startups should consider this technology for several compelling reasons:

- Convenience: Tap-to-pay offers customers a seamless and hassle-free payment experience. It eliminates the need for physical cash or card swiping, making transactions quick and effortless.

- Enhanced Security: These systems often include advanced security features like tokenization, ensuring sensitive payment information remains safe during transactions.

- Adoption by Consumers: Tap-to-pay has gained widespread acceptance among consumers, and its popularity continues to grow. Startups can tap into this trend to attract more users.

- Versatility: Tap-to-pay can be used for various payments, from small everyday purchases to larger transactions. This versatility makes it suitable for a wide range of businesses.

- Competitive Advantage: By offering tap-to-pay options, startups can stay competitive in a market where user experience is paramount.

For startups, adopting tap-to-pay features translates into improved customer satisfaction, increased transaction volumes, and a competitive edge in the FinTech industry. As more and more consumers embrace this technology, startups integrating tap-to-pay into their payment solutions will be better positioned to thrive in the dynamic world of FinTech payments in 2024.

6. Increase in Buy Now Pay Later Plans

One prominent trend that startups should embrace is the increase in Buy Now Pay Later (BNPL) plans. BNPL plans allow consumers to make purchases and defer payment, often without interest or fees, if paid within a specified timeframe. Here's why startups should consider adopting BNPL:

- Consumer Demand: There's a growing demand for flexible payment options among consumers. BNPL plans to cater to this demand, attracting more users to your platform.

- Increased Sales: By offering BNPL, startups can boost their sales as customers are more likely to purchase when they can spread payments over time.

- Customer Loyalty: BNPL plans can enhance customer loyalty as users appreciate the convenience and flexibility offered by this payment method.

- Competitive Edge: Embracing BNPL puts startups ahead of the competition, especially when targeting millennial and Gen Z consumers who are more inclined toward these payment options.

However, startups should be cautious of potential cyber threats, such as data breaches or fraudulent transactions that can target BNPL systems. It's crucial to invest in robust cybersecurity measures to safeguard user data and ensure the integrity of BNPL transactions.

.webp)

Out of Buy Now, Pay Later users, 45% utilize the service frequently, at least once a month or more. When shopping online, nearly half, precisely 47%, report using it "most of the time" or every time they make a purchase. Adopting BNPL plans can drive growth for startups in the FinTech payments industry in 2024, but a strong focus on security is essential to mitigate associated risks.

7. The Rise of Net Banking

Net Banking, or Internet Banking or Online Banking, refers to digitalizing traditional banking services. The rise of Net Banking significantly affects startups in various ways. It presents opportunities for startups to develop innovative FinTech solutions that cater to the growing demand for online banking services. Startups can focus on creating user-friendly mobile apps, secure payment platforms, and tools that simplify financial transactions.

This trend encompasses various types of online financial services, including:

- Online Account Management: Users can check their bank account balances, view transaction histories, and manage their finances from the convenience of their computers or mobile devices.

- Bill Payments: Net Banking allows users to pay bills, transfer funds, and conduct various financial transactions online, eliminating the need for physical visits to banks or payment centers.

- Peer Payments: Peer-to-peer payment platforms enable individuals and businesses to send and receive money seamlessly, fostering cashless transactions.

- Mobile Payments: Mobile banking applications provide users with on-the-go access to their financial accounts and the ability to make payments using their smartphones.

.webp)

Online banking activities were led by mobile communication payments (78%) and balance/deposit transactions (73%). The least utilized services included account opening (16%) and 'Others' (25%). Services like online store payments (53%) and payments for housing services (50%) were also significant, indicating users' diverse use of Internet banking.

By capitalizing on the trend of Net Banking, startups can position themselves at the forefront of the evolving FinTech landscape in 2024 and offer valuable solutions to individuals, businesses, and financial institutions seeking convenient and efficient banking experiences.

8. Application of Generative AI in Banking

The application of Generative Artificial Intelligence (AI) in banking is a trend that startups must note. Generative AI is a subset of artificial intelligence that generates new content, ideas, or solutions. In banking, Generative AI is used for various purposes, including:

- Customer Service: AI-powered chatbots and virtual assistants can provide real-time customer support, enhancing the user experience.

- Risk Assessment: Generative AI can analyze vast amounts of financial data to identify potential risks and suggest risk mitigation strategies, crucial for startups managing their financial services.

- Personalized Financial Advice: Generative AI can offer personalized financial advice and investment recommendations by understanding individual financial profiles and attracting and retaining users.

- Fraud Detection: AI algorithms can detect unusual transaction patterns and potential fraud, ensuring the security of financial transactions.

.webp)

The estimated market size for generative AI in the banking and finance sector was approximately USD 712.4 million in 2022. Projections indicate that it is anticipated to reach a substantial figure of approximately USD 12,337.87 million by 2032. This growth is expected to occur steadily, with a compound annual growth rate (CAGR) of 33% projected during the forecast period spanning from 2023 to 2032.

For startups in the FinTech sector, integrating Generative AI can be a game-changer. It allows for the development of innovative banking solutions, personalized financial services, and improved risk management. By leveraging AI in FinTech, startups can offer competitive and advanced services, attracting more users and staying at the forefront of the FinTech industry in 2024.

The Outlook for FinTech Payments: 2024 and Beyond

The FinTech industry has been at the forefront of innovation, transforming how businesses and individuals make payments. Let's delve into the key trends and developments shaping the future of FinTech payments, focusing on critical aspects of financial technology.

Digital Currencies and Cryptocurrencies

One of the most significant trends in FinTech payments is the adoption of digital currencies and cryptocurrencies. Bitcoin, Ethereum, and various other cryptocurrencies have gained widespread acceptance as alternative forms of payment. Furthermore, central banks worldwide are exploring the concept of central bank digital currencies (CBDCs). These digital currencies can potentially revolutionize how we make payments and store value.

In 2024 and beyond, we anticipate a continued surge in the use of digital currencies for everyday transactions. FinTech companies are working tirelessly to integrate these digital assets into their platforms, allowing users to buy, sell, and transact using cryptocurrencies. For small businesses, this presents a unique opportunity to tap into a growing market of crypto-savvy consumers.

Cross-Border Payments Simplification

Cross-border payments have historically been plagued by complexity and high fees. However, FinTech innovations are changing the game. In 2024, we can expect further simplification of cross-border payments. FinTech companies are developing solutions that make sending money internationally more accessible and cost-effective for businesses and individuals.

These innovations will profoundly impact businesses engaged in global trade and individuals sending remittances to their families in other countries. Small business owners can benefit from reduced fees and faster settlement times, making expanding their reach to international markets easier.

Biometric Authentication

Enhanced security measures are a top priority in the FinTech industry. Biometric authentication methods like fingerprint and facial recognition are becoming increasingly prevalent. These technologies provide an additional layer of security, ensuring that payments are convenient and highly secure.

For small business owners and online businesses, biometric authentication can help protect against fraudulent transactions and unauthorized access to financial accounts. Customers can enjoy the peace of mind that their financial information is safeguarded by cutting-edge technology.

Sustainable and Green Finance

FinTech payments also embrace sustainability in an era of growing environmental concerns. FinTech companies offer options for eco-conscious consumers and businesses to support environmentally friendly initiatives through their financial transactions. FinTech innovations even extend to green financing options, allowing users to apply for a secured loan that supports sustainable projects and environmentally responsible investments. This includes offsetting carbon emissions, investing in green projects, and making sustainable choices when managing finances.

Embedded Finance

Embedded finance, integrating financial services into non-financial platforms and apps, is poised to become more widespread in 2024. This trend allows users to access financial products and services seamlessly within their daily activities. For example, e-commerce platforms can offer instant loans to businesses to help with inventory purchases, mobile technology can facilitate on-the-go payroll management for employees, and a spending app can help users track expenses and manage budgets without leaving the platform.

Small businesses can benefit from embedded finance by directly accessing financing options, payment processing services, and other financial tools through the platforms they already use for their operations.

Key Takeaway

The dynamic landscape of financial technology is rapidly evolving, and understanding the potential opportunities is crucial for success. Looking towards the future, the prospects of FinTech payments beyond 2024 are up and coming. This shift concerns technology and how these advancements can be leveraged to create more efficient, secure, and user-friendly payment solutions.

FinTech app developers are at the forefront of this revolution, crafting solutions that redefine how we manage and process financial transactions. The role of FinTech software developers becomes increasingly crucial as they are tasked with integrating emerging technologies to enhance user experience and security.

As we delve deeper into the future, the scope for FinTech payments expands, presenting many opportunities for innovation and growth. This evolution necessitates startups to be agile and responsive to the changing dynamics. By leveraging the expertise of FinTech software developers and software professionals, startups can stay ahead in the competitive landscape.

Explore our blogs to dive deeper into these trends and learn more about the evolving world of FinTech payments. For further inquiries or to discuss potential collaborations, contact our team at [email protected]. Our FinTech development expertise uniquely positions us to help startups navigate and excel in this exciting field.